Repaying your income progress is often straightforward. Your employer or credit rating union can deduct the quantity borrowed — as well as any desire and costs — from your paycheck.

Activated, chip-enabled GO2bank card expected to purchase eGift Cards. Energetic GO2bank account needed to receive eGift Cards, eGift Card merchants subject matter to change, plus the proportion of cash back from Just about every service provider.

You need to be considered a lawful U.S. resident and of legal age within your condition to sign up. Dave also works by using your Social Security selection for identity verification functions.

Specifically, it’ll think about the total and frequency of one's direct deposits. It may additionally consider your investing habits.

Earnin can be an app that permits you to entry your money earlier than your ordinary pay out cycle. Every time you will need extra funds, you'll be able to Command the amount you would like to withdraw. There isn't any charges, fascination, or concealed fees connected with the Earnin application.

ExtraCash™ can be a DDA account with overdraft utility, developments are issue to eligibility necessities and identity verification. Getting an ExtraCash™ advance is likely to make your account balance unfavorable.

There are only two demands to make use of DailyPay. You'll want to function for an employer that companions with DailyPay. You must also obtain your paycheck by direct deposit to your checking account, pay as you go debit card or payroll card.

Once you sign up for MoneyLion, you’ll must pay out a charge of $nine.ninety nine a month. That membership price consists of use of services like overdraft safety, assistance to repay loans, and no late expenses.

Addressing debt here is tricky. While borrowing money from your employer could possibly be the answer, contemplate your choices very carefully just before heading down this route.

A wage advance arrives from your employer. Some businesses present advances as non-public loans on to workers. Other businesses sponsor a credit score union just for workers. Employers with credit rating unions usually provide salary developments by means of your credit history union account.

Companies desire staff members who aren’t in economical distress. Choose the example higher than involving auto repairs. If you can’t travel your vehicle, you might not be capable of get to operate constantly.

Prior to deciding to give out sensitive details, examine customer testimonials. Yow will discover these wherever you download your apps. Also, you’d be a good idea to operate the corporation’s identify with the CFPB Buyer Grievance Databases.

Numerous apps advertise instance developments however you might need to wait a few minutes to a couple several hours ahead of the cash can be obtained. However, any applications on this checklist may get you your money swiftly (for any payment).

A paycheck advance application helps you to make use of your smartphone to borrow money in between paychecks. As opposed to working a credit check, the application will overview your bank account to ascertain your eligibility.

Neve Campbell Then & Now!

Neve Campbell Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Keshia Knight Pulliam Then & Now!

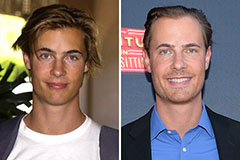

Keshia Knight Pulliam Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now!